Nj Farm Property Tax Exemption . The state farmland evaluation committee annually sets values. improvements of the types and like listed in n.j.s.a. an applicant for a farmland assessment must own the land and file an application with the municipal tax assessor. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. tax assessors determine which land qualifies as farmland. there are several requirements before your property can be assessed as a farm. First, it must be at least five acres,. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes.

from www.formsbank.com

improvements of the types and like listed in n.j.s.a. First, it must be at least five acres,. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. an applicant for a farmland assessment must own the land and file an application with the municipal tax assessor. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. The state farmland evaluation committee annually sets values. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. there are several requirements before your property can be assessed as a farm. tax assessors determine which land qualifies as farmland.

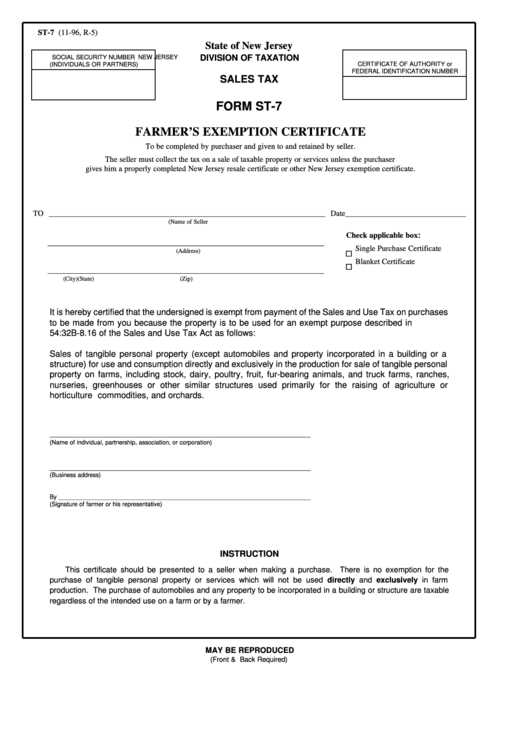

Fillable Form St7 Farmer'S Exemption Certificate printable pdf download

Nj Farm Property Tax Exemption the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. The state farmland evaluation committee annually sets values. an applicant for a farmland assessment must own the land and file an application with the municipal tax assessor. First, it must be at least five acres,. improvements of the types and like listed in n.j.s.a. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. there are several requirements before your property can be assessed as a farm. tax assessors determine which land qualifies as farmland. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the.

From www.pdffiller.com

Fillable Online New Jersey Tax Exempt Certificate Fax Email Print Nj Farm Property Tax Exemption an applicant for a farmland assessment must own the land and file an application with the municipal tax assessor. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. First, it must be at least five acres,. tax assessors determine which land qualifies as. Nj Farm Property Tax Exemption.

From printableformsfree.com

Nj Tax Exempt Fillable Form Printable Forms Free Online Nj Farm Property Tax Exemption in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. The state farmland evaluation committee annually sets values. tax assessors determine which land qualifies as farmland. First, it must be at least five acres,. the following examples are offered to assist in understanding the criteria to qualify land for. Nj Farm Property Tax Exemption.

From dxodrehvd.blob.core.windows.net

Va Property Tax Exemption New Jersey at Gilbert Hagan blog Nj Farm Property Tax Exemption in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. there are several requirements before your property can be assessed as a farm. The state farmland. Nj Farm Property Tax Exemption.

From www.njspotlightnews.org

Charting property taxes in New Jersey NJ Spotlight News Nj Farm Property Tax Exemption the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. an applicant for a farmland assessment must own the land and file an application with the municipal tax. Nj Farm Property Tax Exemption.

From printableformsfree.com

Nj Tax Exempt Fillable Form Printable Forms Free Online Nj Farm Property Tax Exemption improvements of the types and like listed in n.j.s.a. an applicant for a farmland assessment must own the land and file an application with the municipal tax assessor. tax assessors determine which land qualifies as farmland. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under. Nj Farm Property Tax Exemption.

From www.uslegalforms.com

Nj Tax Exempt Form St 5 20202022 Fill and Sign Printable Template Nj Farm Property Tax Exemption with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. First, it must be at least five acres,. an applicant for a farmland assessment must own. Nj Farm Property Tax Exemption.

From www.formsbank.com

Top 21 Property Tax Exemption Form Templates free to download in PDF format Nj Farm Property Tax Exemption there are several requirements before your property can be assessed as a farm. The state farmland evaluation committee annually sets values. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. an applicant for a farmland assessment must own the land and file an application with the municipal tax. Nj Farm Property Tax Exemption.

From exoqpwoaw.blob.core.windows.net

Solano County Property Tax Exemption Form at Hae Ferguson blog Nj Farm Property Tax Exemption improvements of the types and like listed in n.j.s.a. The state farmland evaluation committee annually sets values. there are several requirements before your property can be assessed as a farm. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. in 1963 the. Nj Farm Property Tax Exemption.

From staybite11.bitbucket.io

How To Lower Property Taxes In Nj Staybite11 Nj Farm Property Tax Exemption the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. First, it must be at least five acres,. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. with the new rules now in effect, the law may. Nj Farm Property Tax Exemption.

From www.formsbank.com

Farm Exemption Certificate printable pdf download Nj Farm Property Tax Exemption tax assessors determine which land qualifies as farmland. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. First, it must be at least five acres,.. Nj Farm Property Tax Exemption.

From www.dochub.com

Nj resale certificate Fill out & sign online DocHub Nj Farm Property Tax Exemption there are several requirements before your property can be assessed as a farm. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. improvements of the types and like listed in n.j.s.a. First, it must be at least five acres,. in 1963 the. Nj Farm Property Tax Exemption.

From wolfcre.com

New Jersey Real Property Tax Exemption Overview WCRE Nj Farm Property Tax Exemption in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. there are several requirements before your property can be assessed as a farm. an applicant for a. Nj Farm Property Tax Exemption.

From www.templateroller.com

Form ST7 Fill Out, Sign Online and Download Fillable PDF, New Jersey Nj Farm Property Tax Exemption with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. improvements of the types and like listed in n.j.s.a. The state farmland evaluation committee annually sets values. tax assessors determine which land qualifies as farmland. the following examples are offered to assist in. Nj Farm Property Tax Exemption.

From www.skoloffwolfe.com

New Jersey Property Tax Appeal Lawyer, Tax Exemption Attorney Nj Farm Property Tax Exemption tax assessors determine which land qualifies as farmland. improvements of the types and like listed in n.j.s.a. First, it must be at least five acres,. The state farmland evaluation committee annually sets values. in 1963 the constitution was amended to permit the assessment of farmland at its value for agricultural purposes. the following examples are offered. Nj Farm Property Tax Exemption.

From www.njpp.org

Why Significant, Lasting Property Tax Reform is So Difficult New Nj Farm Property Tax Exemption improvements of the types and like listed in n.j.s.a. First, it must be at least five acres,. tax assessors determine which land qualifies as farmland. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. The state farmland evaluation committee annually sets values. with the. Nj Farm Property Tax Exemption.

From www.tptools.com

State Tax Exemption Forms TP Tools & Equipment Nj Farm Property Tax Exemption an applicant for a farmland assessment must own the land and file an application with the municipal tax assessor. First, it must be at least five acres,. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. the following examples are offered to assist. Nj Farm Property Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF Nj Farm Property Tax Exemption there are several requirements before your property can be assessed as a farm. the following examples are offered to assist in understanding the criteria to qualify land for preferential reduction in taxes under the. with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms.. Nj Farm Property Tax Exemption.

From www.dochub.com

St8 form Fill out & sign online DocHub Nj Farm Property Tax Exemption with the new rules now in effect, the law may have led to a small reduction in the number of properties considered farms. First, it must be at least five acres,. there are several requirements before your property can be assessed as a farm. the following examples are offered to assist in understanding the criteria to qualify. Nj Farm Property Tax Exemption.